On July 24, Lisa hosted a forum consisting mostly of a presentation by Amy Castleberry, Managing Director at Ziegler Investment Banking. Ziegler is in the business of arranging loans and bond offerings for non-profits, many of them retirement communities. Castleberry’s presentation was about trends in the retirement industry, focusing (as might be expected, given her job) mainly on the financial issues and closely related topics. A major theme was growth.

The video of the forum is here.

Castleberry began by reviewing the wave of Baby Boomers hitting retirement age. (Jan and I are at the forefront of that wave.) There will be a far greater number of retirees over the next decade or two than has been the case in previous decades, and Boomers are less likely to have children nearby (or to have children at all) who might help them in retirement. Furthermore, Boomers have higher rates of obesity, addiction, and Alzheimer’s than their predecessors. There will be enormous demand for senior housing.

Next, Castleberry talked about where KCC fits in the spectrum of non-profit senior living. Almost all LifePlan (CCRC) communities are non-profits. Because of our four campuses, Ziegler classifies us as a “multi-site” operation. Many multi-site chains are huge. We are the 120th largest among multi-sites nationally. If all of us (Kendal, Crosslands, Cartmel, and Conniston) were considered a single site, we’d be the 2nd largest in Pennsylvania. (Castleberry didn’t say this, but even if Kendal and Crosslands were each considered a single site, each would be in the top 20 single-site communities in size in PA, according to Ziegler data.)

In terms of occupancy, we’re doing very well. We are basically full, while the average occupancy for LifePlan communities is in the low 90s. We don’t apply for credit ratings (“because you use bank loans”), but we are financially very strong. Our fee increases have been in line with the rest of the industry.

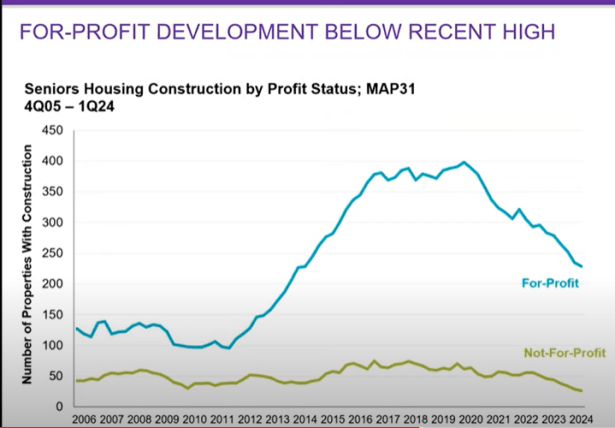

Growth. Castleberry then turned to the growth of the senior housing industry. The industry is growing, but not nearly as fast as it was prior to Covid. The growth of the for-profit part of the industry, in particular, has slowed down a lot. That is illustrated in the following slide from Castleberry’s presentation.

The for-profit communities have been largely funded as real estate investments, and they have done poorly in the recent period of rising interest rates. This presents “an opportunity for not-for-profits and for KCC”, Castleberry believes.

Most new communities (whether for-profit or not) will not offer nursing. Of the 40 new not-for-profit communities planned for the next 5 years, only 10 will be LifePlan communities. The other 30 will not offer medical care.

Growth can take a variety of forms. It can take the form of adding units to an existing campus or opening a new campus. There is an opportunity to offer rental-based projects (no entrance fee) to middle-income retirees who don’t have a nest egg large enough to pay a big entrance fee.

Some retirement operations are branching out to provide “home and community-based care” for customers who are not residents. 45% of multi-site operations and 18% of single sites offer this. In addition to home care and help with access to medical services, they may offer other services such as hospice, pharmacy services, behavioral/mental health services, technology, rehab, and more.

Technology. Lots of retirement communities are getting heavily into technology, either to help the staff or to help residents. Castleberry divided the technology into seven categories: telehealth, communication and engagement, workforce solutions (such as digital records), brain fitness/cognitive care, resident monitoring and fall solutions, care coordination solutions, and smart home technology (e.g. Alexa voice-controlled technology).

Consolidation. The retirement industry is going through a period of consolidation. There have been over 1,000 “transactions” (mergers, acquisitions, bankruptcies) since 2015. During the peak Covid period, some communities and chains went through financial crises and were acquired. Now, there are fewer with immediate financial crises. Instead, Castleberry said, “We are seeing organizations saying, ‘I know how I’m going to get through next 3 years, but given everything that’s changing, I don’t see how I’m going to get through the next 10 years. Let me find a partner.’ And that, again, is going to present an opportunity for Kendal-Crosslands Communities as people potentially seek them out as that stronger partner, as a way to grow.”

In a survey of retirement communities, the biggest problems reported in 2023 were: the ability to attract and retain staff, the complexities of skilled nursing and healthcare, financial pressure, and leadership turnover.

As an indication of how much consolidation has been happening, Castleberry cited statistics that multi-site chains were just 52.2% of the industry in 1980, but in 2023 that figure was up to 71.9%. (Those figures include both profit-making and not-for-profit communities, however. Among not-for-profits, the trend is much weaker: 59% multi-site in 1980 and 62% in 2023.)

What does all this mean for KCC? The big themes of Castleberry’s talk were growth and consolidation. Is there major growth or consolidation in KCC’s future? That question arose in the Q&A at both Crosslands (where Castleberry had given her presentation in the morning) and at Kendal.

At Crosslands, Allan Falcoff asked why KCC had asked Castleberry to make this presentation. Castleberry replied that residents should know “how this community fits into the larger sector, what are the challenges now, what are the opportunities ahead. I would like to think that once the strategic planning is done, or once management is ready to interact with residents about what some of those possibilities will be, you won’t be hearing about growth for the first time, or consolidation for the first time. But you might be able to think back and say, ‘Oh yes, OK, they are talking about consolidation because this is a very big trend in the larger industry’ or they’re talking about—I’m making this up—building a satellite campus two miles down the road, because we know there’s this huge wave of seniors that are going to want to live here and we can’t serve them now.”

Lisa added that her responsibility as CEO was to “keep this type of information in front of our Board from an educational perspective, to keep this type of information in front of my management team for their information. It helps to educate us so that we know what’s going on around us, and especially as you go into strategic planning, I think it’s only wise for our Board to know what’s going on in the greater community, how we relate to what’s going on in the greater community, so that we all understand where we’re at.”

At Kendal, Joe Volk asked what advantage there would be to growth. Castleberry replied that if our mission is to serve seniors, growth would allow us to serve more of them. She also mentioned that the admission fees associated with growth can help pay for construction of non-revenue-generating facilities.

Are we headed for growth? If so, why and what kind? Personally, I don’t see a need for growth. The resident population at Kendal is already somewhat larger than I would consider ideal, and that’s probably true at Crosslands too.

I certainly hope we don’t get acquired by a large chain. That could easily signal the end of everything that makes KCC distinctive. (Fortunately, that’s not likely—it’s generally financially weak organizations that get acquired.) Nor would I be in favor of acquiring another retirement community, unless perhaps they already have a very similar culture to ours. Even then, the administrative and financial burden of an acquisition would be likely to have negative consequences for us.

I can imagine expanding our home care service out into the surrounding community. (But Castleberry pointed out that staffing such a service can be even more difficult than the kinds of staffing issues we already face.)

I can also imagine (if for some reason we really want to expand) that a case could be made for opening a middle-market rental-type retirement facility, perhaps repurposing a rehabbed industrial building in Kennett, West Chester, or Downingtown. It would be a major undertaking, of course. Non-entrance-fee communities are the type of senior living that will probably be needed most in the decades to come. If our Board decides expanding to serve more seniors is a high priority, that’s the direction I hope they would choose to go.

Well done, George. When I was on the Board there wasn’t much appetite for expanding KCC, say to another piece of land. The one exception was an interest in figuring out a way to serve seniors who could not afford the KCC life-plan communities. There was some exploration of suitable properties, but I do not remember any discussion of what a lower-cost model would look like. So, no movement. Rick Spackman, toward the end, was the lead Board member tasked with the inquiry.

Tom

LikeLike